Payment Security

PCI SSF Services

Consult our experts. We are happy to support you.

What atsec offers

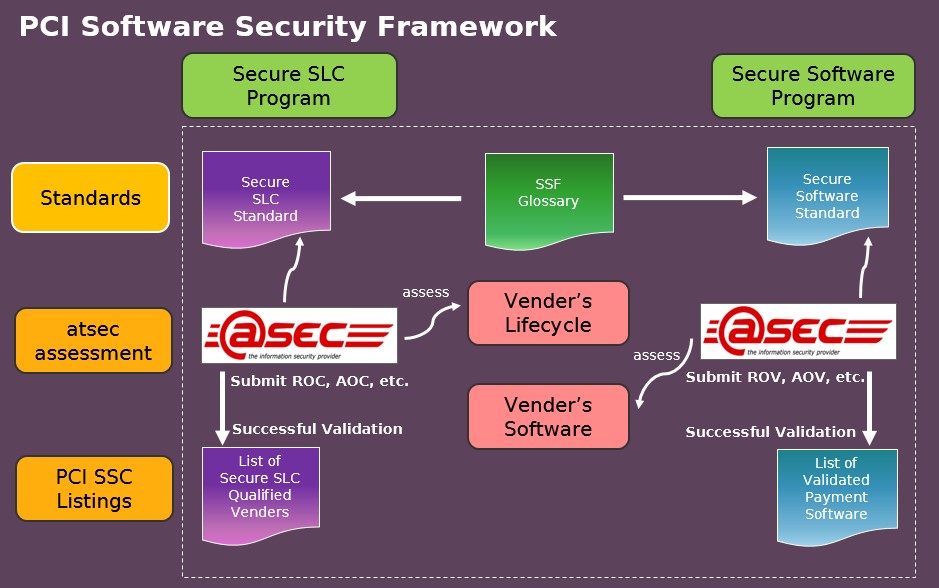

atsec China is accredited as a Secure Software Lifecycle (SLC) Assessor and Secure Software Assessor company by the PCI SSC (Payment Card Industry Security Standards Council) under the PCI Software Security Framework (SSF) program. atsec can work with the global software vendors to evaluate a vendor’s software lifecycle and/or validate a vendor’s payment software.

atsec China is accredited as a Secure Software Lifecycle (SLC) Assessor and Secure Software Assessor company by the PCI SSC (Payment Card Industry Security Standards Council) under the PCI Software Security Framework (SSF) program. atsec can work with the global software vendors to evaluate a vendor’s software lifecycle and/or validate a vendor’s payment software.

As a qualified Secure Software Assessor, atsec can perform Secure Software Assessments according to the Secure Software Standard. This standard provides security requirements for building secure payment software to protect the integrity and the confidentiality of sensitive data that is stored, processed, or transmitted in association with payment transactions. Upon successful evaluation by atsec as one of the Secure Software Assessors, validated payment software will be recognized on the PCI SSC List of Validated Payment Software, which will supersede the current List of Validated Payment Applications when PA-DSS is retired the end of October 2022.

In addition to the assessment service, atsec offers a full range of consulting services to support your organization in achieving compliance with the security standards.

Why our services are important to you

The PCI SSF is a collection of standards and programs for the secure design and development of payment software. Security of payment software is a crucial part of the payment transaction flow and is essential to facilitate reliable and accurate payment transactions. The SSF replaces the Payment Application Data Security Standard (PA-DSS) with modern requirements that support a broader array of payment software types, technologies, and development methodologies. With its outcome-focused requirements, the SSF provides more agility for developers to incorporate payment application security with nimble development practices and frequent update cycles. The SSF enables accelerated provision of customization and features for payment applications for merchants without compromising security. It also improves consistency and transparency in testing payment applications, which elevates validation assurance for merchants, service providers, and acquirers that implement and manage the use of payment solutions.

Authoritative websites:

More information:

Change Language:

Still have questions?

Can’t find what you’re looking for? Let’s talk!